In the ever-changing world of trading, staying ahead means adapting to new tools, strategies, and technologies. One of the latest buzzwords making waves among traders is the Naomi Swap — a concept that’s redefining how investors manage positions, hedge risks, and tap into global market opportunities.

If you’ve been wondering what Naomi Swap is all about or how it could enhance your trading game, you’re in the right place. Let’s break it down in simple terms, explore how it works, and uncover the real benefits (and challenges) you should know before diving in.

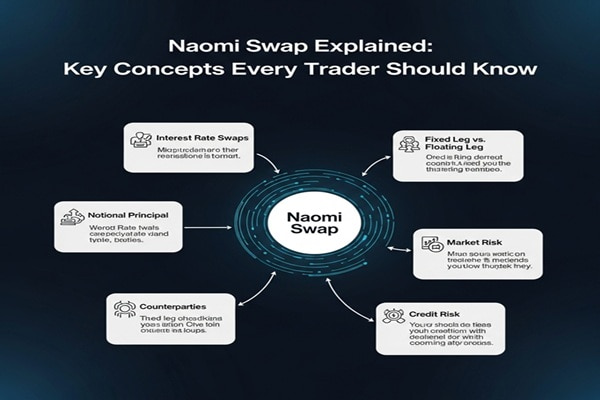

What Exactly Is the Naomi Swap?

Imagine being able to exchange one type of asset for another — not permanently, but for a set period — to take advantage of shifting market conditions. That’s the basic idea behind the Naomi Swap.

In essence, it’s a financial contract between two parties where they agree to swap cash flows or assets based on specific conditions. You might exchange returns from one currency or interest rate for another, all without having to physically own the underlying assets.

For example:

-

In an interest rate swap, you could trade fixed interest payments for floating ones.

-

In a currency swap, you might exchange payments in one currency for another to hedge against forex fluctuations.

What makes the Naomi Swap special is its flexibility. It blends elements of traditional swaps with innovative trading tools, making it a go-to option for both hedging risk and enhancing profitability in dynamic markets.

How Naomi Swap Works (Without the Jargon)

Let’s keep it simple: the Naomi Swap allows traders to temporarily “trade places” in terms of returns.

Here’s how it generally works:

-

Two traders or institutions agree to swap returns on specific assets — for example, one based on a fixed rate and another on a variable rate.

-

The terms are set in advance, including how long the swap will last and how payments will be calculated.

-

As the market fluctuates, each party gains or loses based on the movement of those underlying assets.

You’re essentially betting on how these movements play out — but with far more control and risk management potential than traditional speculation.

Because Naomi Swaps don’t always require ownership of the underlying assets, they’re ideal for traders who want exposure to new markets without heavy capital commitments.

Why Naomi Swap Is Gaining Popularity Among Traders

So, why is everyone suddenly talking about Naomi Swap? The answer lies in its versatility and practicality.

Here are some of the biggest reasons it’s trending:

-

Flexibility: Traders can hold their positions longer without worrying about short-term price swings.

-

Profit Opportunities: By leveraging interest rate differentials or price variations, traders can generate additional income.

-

Risk Management: Naomi Swap provides an effective way to hedge against volatility, whether in currencies, commodities, or other financial instruments.

-

Accessibility: It’s suitable for a wide range of traders — from individual investors to institutional players — thanks to its adaptable structure.

-

Global Reach: It opens doors to markets that might otherwise be hard to access through traditional methods.

In a world where every second counts and market conditions can change in an instant, Naomi Swap gives traders a strategic advantage to stay nimble and profitable.

The Major Benefits of Trading with Naomi Swap

Let’s take a closer look at why Naomi Swap could be a game-changer for your trading approach:

1. Greater Flexibility

You’re not locked into one market or asset type. Naomi Swap allows you to adjust your exposure quickly, so you can pivot when opportunities arise.

2. Better Risk Management

Markets can be unpredictable, but Naomi Swap helps smooth out volatility. You can hedge against interest rate changes, currency fluctuations, and other potential pitfalls.

3. Enhanced Profitability

If you’re savvy with timing and analysis, you can capitalize on interest rate spreads or market discrepancies to boost your returns.

4. Diversification Made Easy

By using Naomi Swap, traders can explore different asset classes without overextending their portfolios. It’s a smart way to diversify without overcomplicating your trading setup.

5. Improved Liquidity Access

Swaps often open doors to liquid markets that might otherwise be off-limits to smaller investors. This gives you more control over when and how to enter or exit trades.

Risks and Challenges You Should Know

Of course, no trading instrument is without risk. Naomi Swap has plenty of advantages, but it’s essential to understand its potential downsides too.

Here’s what to watch out for:

-

Market Volatility: Sudden changes in interest rates or currency values can lead to losses.

-

Liquidity Constraints: In volatile markets, executing swaps at favorable prices might become difficult.

-

Complexity: Naomi Swap agreements can be technical, so beginners may need time to fully grasp the details.

-

Regulatory Changes: Governments and financial regulators may adjust rules affecting how swaps operate, so keeping up with updates is key.

The best way to mitigate these risks? Stay informed, diversify your portfolio, and avoid over-leveraging.

How to Get Started with Naomi Swap

Ready to explore Naomi Swap trading? Here’s how you can ease into it:

-

Learn the Basics: Understand core financial terms like interest rate swaps, spreads, and hedging.

-

Start Small: Begin with smaller contracts or demo accounts to test strategies before committing real funds.

-

Use Trusted Platforms: Always trade through reputable brokers or platforms that support swap agreements.

-

Set Clear Goals: Define what you want to achieve — whether it’s risk reduction, profit optimization, or diversification.

-

Monitor the Market: Keep an eye on macroeconomic trends, interest rate policies, and currency shifts.

-

Leverage Analytical Tools: Use charting software, economic calendars, and risk calculators to make informed decisions.

And remember — patience and consistency often make the difference between success and frustration in trading.

Also Read : The Rise of Ovppyo: What You Need to Know

Pro Tips for Successful Naomi Swap Trading

To truly master Naomi Swap, here are a few tried-and-true tips:

-

Stay Educated: Markets evolve quickly, so continuous learning is key.

-

Don’t Overtrade: Only engage in swaps when it aligns with your broader trading strategy.

-

Manage Emotions: Avoid impulsive decisions; let your strategy guide your actions.

-

Keep a Trading Journal: Document every trade, including reasoning, outcomes, and lessons learned.

-

Network with Other Traders: Joining online forums or professional groups can provide valuable insights and strategies.

The Future of Naomi Swap in the Trading World

As global markets become more interconnected, tools like Naomi Swap will continue to grow in relevance. They provide traders with the flexibility to adapt to changes in interest rates, currencies, and cross-border trade dynamics.

We’re already seeing brokers and fintech companies integrate swap functionalities into their platforms, making it easier than ever for retail traders to participate.

With AI-driven trading algorithms and real-time analytics, the Naomi Swap is poised to become a mainstream financial instrument for both short-term and long-term traders.

Final Thoughts: Is Naomi Swap Worth Exploring?

Absolutely — if you approach it strategically.

Naomi Swap isn’t just another trading trend; it’s a powerful mechanism that gives traders control, flexibility, and potential for profit in volatile markets. It bridges the gap between traditional investment tools and modern trading innovation.

However, like any financial strategy, success depends on knowledge, discipline, and risk management. The more you understand how it works, the more effectively you can use it to your advantage.

So, whether you’re an experienced trader or just dipping your toes into the world of swaps, the Naomi Swap might just be your next smart move toward a more resilient and profitable trading strategy.